EVA Markets

EVA Markets

Comoros

Pyramid scheme complaint

Expose

Comoros|

1-2 years|

Comoros|

1-2 years|

MT5 Identification

Full License

United Kingdom

United KingdomSingle Core

1G

40G

More

EVA Markets

EVA Markets

Comoros

Pyramid scheme complaint

Expose

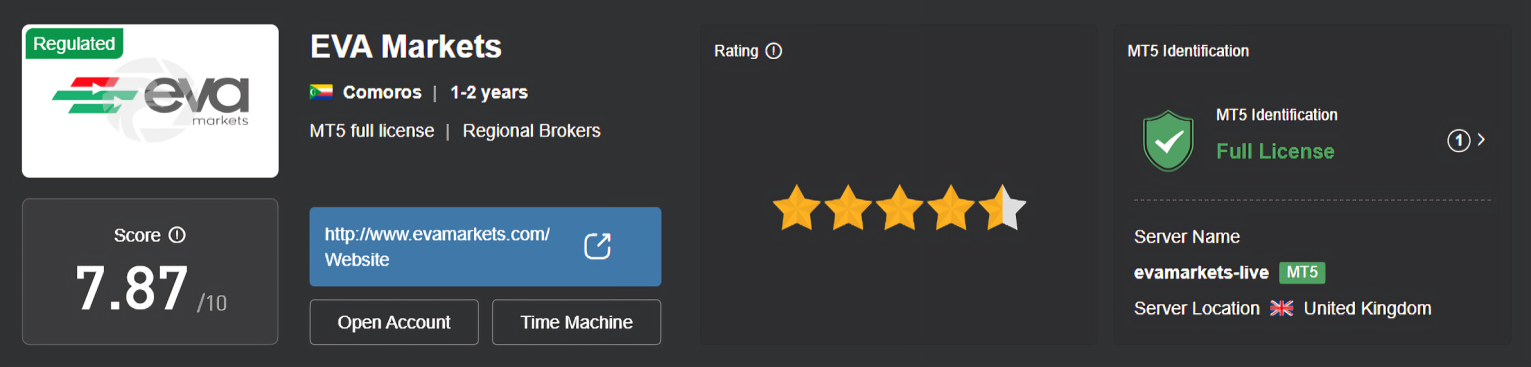

| EVA Markets Review Summary in 10 Points | |

| Founded | 2023 |

| Registered Country/Region | Comoros |

| Regulation | Regulated |

| Market Instruments | Forex, Stocks, Commodities, Indices |

| Demo Account | Not Available |

| Leverage | Up to 1:500 |

| EURUSD Spread | Start from 1.5 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | 1,000 USD |

| Customer Support | Phone, Address, Email, Social media, Enquiry form |

EVA Markets is an international brokerage firm located in Comoros, providing traders with diverse opportunities across Forex, Stocks, Commodities, and Indices. Notably, EVA Markets operates under the strict regulation of the Mwali International Services Authority, ensuring a secure and reliable trading environment.

| Advantages | Disadvantages |

| • Advanced MT5 trading platform | |

| • Diverse customer support options | |

| • No commission fees | |

| • Customizable leverage options | |

| • Free deposits and withdrawals |

If you're exploring other options beyond EVA Markets, there are several alternative brokers that might suit your trading style and preferences. Some noteworthy choices include:

Markets.com - Known for its intuitive platform and extensive range of trading instruments, Markets.com is a reliable choice for traders of all levels, from beginners to professionals.

NAGA - NAGA offers a distinctive experience by blending trading with social networking, enabling users to follow and replicate the strategies of seasoned traders.

Rakuten Securities - With a strong global presence, Rakuten Securities provides a wide array of trading services, prioritizing customer satisfaction and comprehensive support.

Your decision to trade with EVA Markets should be based on careful consideration. We recommend thoroughly evaluating the potential risks and rewards to make an informed choice that aligns with your financial goals.

EVA Markets provides a wide variety of market instruments designed to meet the diverse needs of traders:

Forex (Foreign Exchange): The Forex market enables traders to engage in the exchange of currency pairs, offering high liquidity and the advantage of being open 24/5. Popular pairs such as EUR/USD, GBP/USD, and USD/JPY provide opportunities to capitalize on currency fluctuations.

Stocks: Access a broad range of individual stocks from global exchanges through EVA Markets. Invest in shares of renowned companies, allowing participation in the equity markets with potential gains from stock price appreciation and dividends.

Commodities: Engage in the trading of essential raw materials like precious metals, oil, and agricultural products. Commodity trading is a popular choice for diversifying portfolios and protecting against inflation and economic uncertainties.

Indices: Trade major stock market indices such as the S&P 500, NASDAQ, or FTSE 100. Index trading offers a way to benefit from overall market movements, providing exposure to a basket of stocks rather than individual equities.

EVA Markets offers a Standard Account with a minimum deposit requirement of USD 1,000. This account grants traders access to a comprehensive selection of trading instruments.

The minimum deposit is positioned at a moderate level, making it accessible for those eager to explore different financial markets, including Forex, stocks, commodities, and indices, within a balanced and supportive trading environment.

EVA Markets provides a range of leverage options tailored to suit various trading styles and risk tolerances.

Forex trading offers leverage of up to 1:500, presenting significant profit potential but also increased risk, particularly in volatile market conditions.

Stocks can be traded with leverage up to 1:10, providing a more conservative approach to managing risk while still allowing for enhanced market exposure.

For commodities, leverage up to 1:200 is available, offering flexibility but requiring careful attention to market movements due to the inherent volatility in commodity trading.

Indices can be traded with leverage up to 1:100, enabling traders to capitalize on broader market trends, though it’s essential to apply effective risk management strategies.

At EVA Markets, traders benefit from spreads starting at 1.5 pips, with no additional commissions. This competitive pricing structure is particularly appealing to traders looking to reduce their trading costs while accessing a wide range of markets, including Forex, stocks, commodities, and indices.

Below is a comparative table highlighting spreads and commissions from different brokers:

| Broker | EUR/USD Spread | Commissions |

| EVA Markets | From 1.5 pips | No commissions |

| Markets.com | Not disclosed | Not disclosed |

| NAGA | From 0.7 pips | Variable (depending on product) |

| Rakuten Securities | From 0.5 pips | No commissions |

It’s important to understand that spread values can vary due to market conditions, account types, and other factors. Additionally, commission structures may differ based on the broker’s pricing model and the type of account in use. To obtain the most accurate and up-to-date information on spreads and commissions, it is recommended to review the official broker websites or contact them directly.

EVA Markets provides its clients with access to the highly regarded MetaTrader 5 (MT5) platform. This platform is compatible across multiple operating systems, including Microsoft for desktop users, iOS for Apple enthusiasts, and Android for those who prefer mobile trading. This broad compatibility enables traders to execute their trading activities smoothly, whether at their desktop or on the go. The MT5 platform is well-known for its advanced charting tools, technical indicators, and automated trading features, making it a preferred choice for traders who seek a robust and versatile trading experience.

Overall, EVA Markets trading platforms are designed to be user-friendly and offer a wide range of features, making them suitable for both novice and experienced traders alike.

Below is a comparison of the trading platforms provided by different brokers:

| Broker | Trading Platforms |

| EVA Markets | MT5 |

| Markets.com | MT5, proprietary platform |

| NAGA | NAGA Trader Mobile, NAGA Trader Web, MT5 |

| Rakuten Securities | MT4 |

EVA Markets supports a variety of deposit and withdrawal methods, including popular options such as Mastercard, Visa, and wire transfers. A key advantage is that EVA Markets does not charge any fees for deposits or withdrawals, allowing traders to manage their funds efficiently without incurring unnecessary costs.

EVA Markets offers multiple customer service channels to address the needs of its clients. The support team can be reached via the following methods:

Email: support@evamarkets.com

Address: Bonovo Road, Fomboni Island of Mohéli, Comoros Union.

EVA Markets is a regulated brokerage firm based in Comoros, offering a variety of market instruments, including Forex, Stocks, Commodities, and Indices. It’s essential for potential clients to conduct thorough research and obtain the latest information directly from EVA Markets before making any investment decisions.

| Q 1: | Is EVA Markets regulated? |

| A 1: | Yes, EVA Markets is a regulated broker. |

| Q 2: | Does EVA Markets offer the industry leading MT4 & MT5? |

| A 2: | Yes, EVA Markets offers the MT5 platform, available on Windows, Android, and iOS devices. |

| Q 3: | Is EVA Markets a good broker for beginners? |

| A 3: | Yes, EVA Markets is a solid choice for beginners due to its regulatory status and user-friendly platform. |

| Q 4: | Does EVA Markets offer demo accounts? |

| A 4: | No, EVA Markets does not offer demo accounts. |

| Q 5: | What is the minimum deposit required for EVA Markets? |

| A 5: | The minimum initial deposit required is 1,000 USD. |

| Q 6: | Are there any regional restrictions for traders at EVA Markets? |

| A 6: | Yes, EVA Markets does not provide services to residents of the USA, Canada, Sudan, Syria, North Korea, Iran, Iraq, Libya, Cuba, Myanmar, Yemen, Afghanistan, Vanuatu, and EEA countries. |